South Korean electronics giant Samsung Electronics has long been a leading player, particularly in the memory chip market. However, the past year saw the company grappling with macroeconomic headwinds and weak demand for its products. Fast forward to the first quarter of 2024, and Samsung is once again in the headlines for its impressive financial performance. Operating profits surged an astonishing 930% year-on-year, reaching a record KRW 6.61 trillion ($4.77 billion).

The causes of this remarkable turnaround merit closer examination. After analyzing the latest financial reports and industry trends, it becomes clear that Samsung’s memory chip business was the key driver of this profit surge. The demand for high-performance memory chips, such as high-bandwidth memory (HBM) and DDR5 chips, is soaring due to the increasing adoption of AI technologies, the Internet of Things (IoT), 5G networks, and other advanced applications.

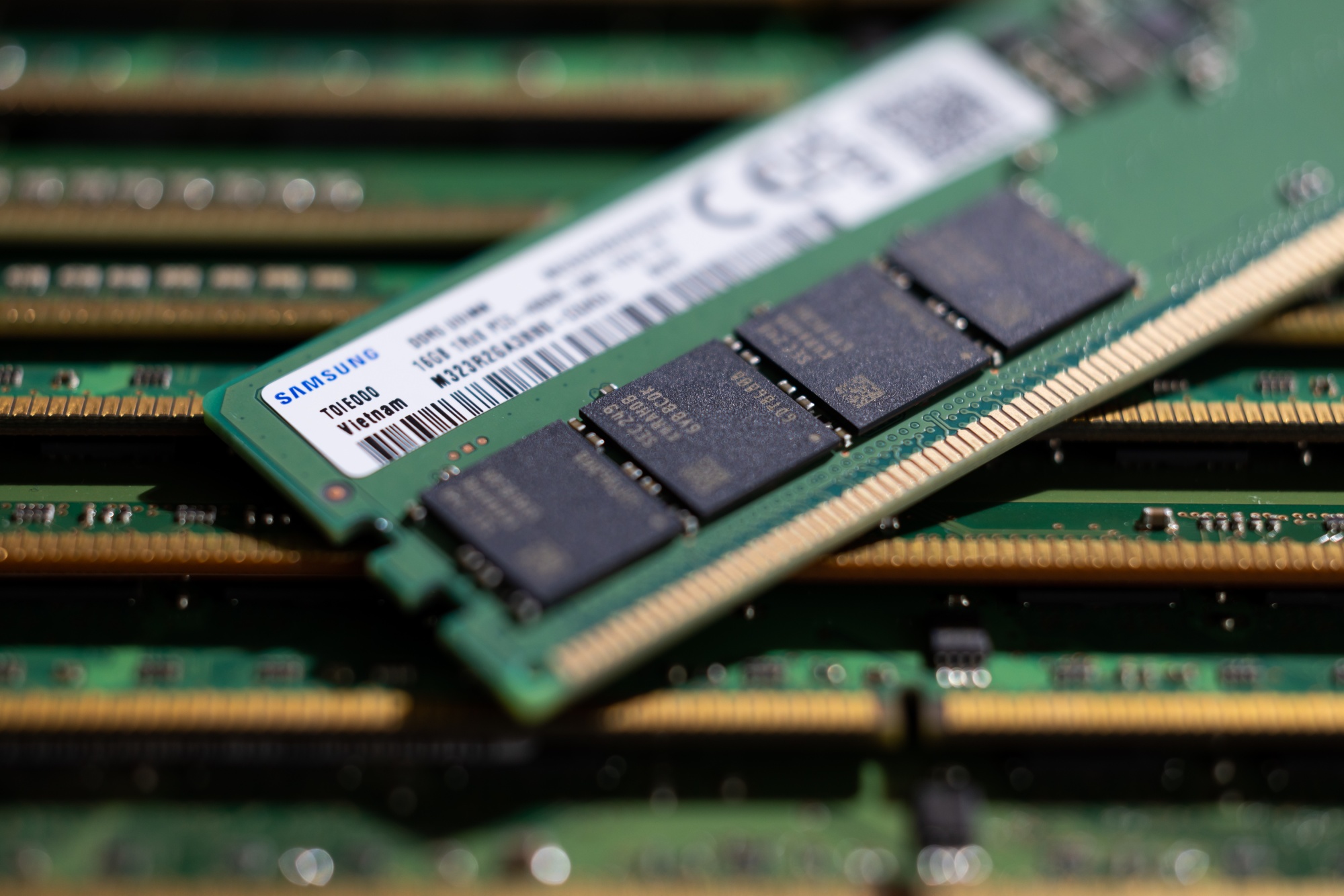

The significance of Samsung’s memory chip business cannot be overstated. As the largest memory chip maker in the world, Samsung competes fiercely with other industry heavyweights, like Micron and SK Hynix, in the high-performance memory chip market. Given the competitive landscape, Samsung’s ability to produce and sell these high-performance chips at scale is a key competitive advantage.

The latest financial reports reveal that Samsung’s sales in the semiconductor division rose from KRW 13.73 trillion ($9.92 billion) to KRW 23.14 trillion ($16.71 billion) in the first quarter of 2024. Operating profit in this division jumped from an operating loss of KRW 4.58 trillion ($3.3 billion) in Q1 2023 to a profit of KRW 1.91 trillion ($1.3 billion) in Q1 2024.

Samsung’s dedication to staying at the forefront of the high-performance memory chip market is evident in its recent plans to mass-produce HBM3E 8H (8-layer) DRAM and V9 NAND chips. These chips are in high demand for AI servers, enterprise servers, and other advanced applications. By capitalizing on this trend, Samsung not only improves its profitability but also strengthens its competitive position in the memory chip market.

Despite this encouraging start, challenges remain. Macroeconomic trends and geopolitical issues continue to display volatility throughout 2024. However, Samsung remains buoyed by the second half of the year, particularly the growth areas of generative AI, servers, and storage solutions. These trends are expected to fuel the demand not only for high-performance memory chips but also for more conventional server and storage solutions, providing a promising outlook for Samsung’s future financial performance.