The emergence of generative artificial intelligence (AI) has sent ripples through the venture capital (VC) industry. Foundation models, such as those developed by OpenAI and Anthropic, have captured the public’s imagination with their human-like language understanding and impressive capabilities. Consequently, these models have attracted significant investments and high valuations.

However, the saturation of the foundation model market and increasing competition among start-ups have led VCs to reassess their investment strategies. In response, they have started to explore opportunities in applications built on top of these foundation models and the infrastructure required to develop and operate advanced AI systems.

Foundation models present formidable challenges for investors. Their development and optimization require substantial computational power, expertise, and resources. Furthermore, the intense competition in the market has driven up valuations to unsustainable levels, making it challenging for VCs to secure attractive returns on their investments.

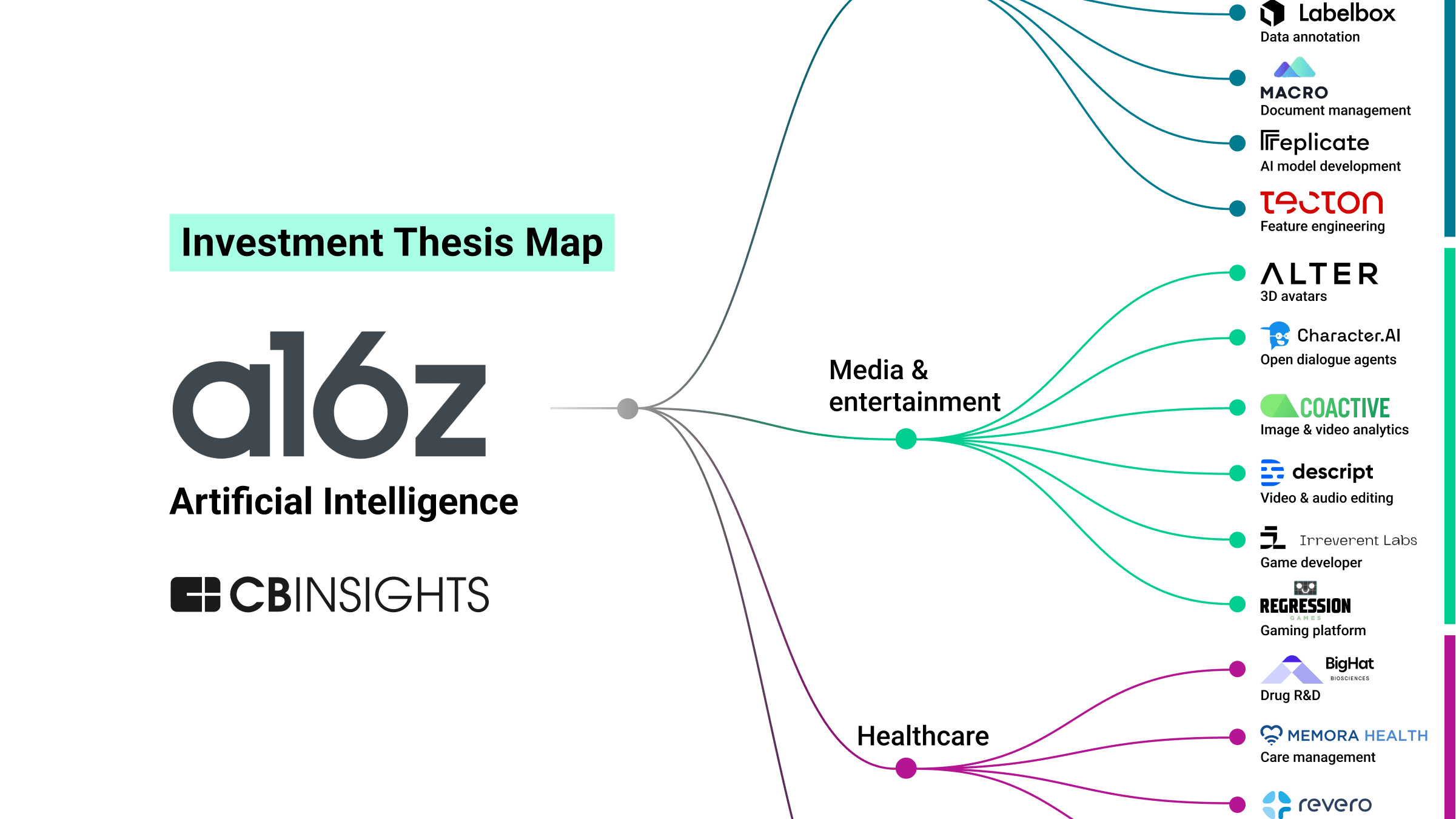

Instead, VCs are discovering the benefits of investing in applications. By focusing on specific industries or use cases, application-focused start-ups can differentiate themselves from competitors, catering to unique customer needs and creating value. Additionally, application investments offer lower entry barriers and potentially higher scalability, making them an attractive alternative to foundation model investments.

Another promising area for VC investment is infrastructure. With the growing need for specialized AI-focused infrastructure, companies building and providing this infrastructure can tap into a significant long-term growth potential. This infrastructure investment focus reflects the evolving landscape of AI and the demands placed on technology businesses to address complex challenges and deliver value.

VCs are shifting their investment focus towards applications and infrastructure to adapt to the maturing AI market. Applications offer the potential for differentiation, lower barriers to entry, and higher scalability, while infrastructure investments address the need for specialized AI-focused infrastructure. By supporting start-ups in these areas, venture capitalists are positioning themselves to generate returns in the evolving AI market while contributing to the expansion and development of the technology sector.

Related Articles

- Applied Intuition lands $6B valuation for AI-powered autonomous vehicle software - TechCrunch

- Amazon to spend $1 billion on startups that combine AI with robots - Ars Technica

- AI2 Incubator scores $200M in compute to feed needy AI startups - TechCrunch

- Amazon pours an additional $2.75 billion into AI startup Anthropic - The Washington Post