In recent years, a notable trend has emerged in the venture capital (VC) industry: a marked slowdown in fundraising. Venture capital firms, once the engine of record-breaking investment, have found it increasingly challenging to secure capital from institutional investors. This shift has profound implications for start-ups, as access to venture capital is a vital catalyst for growth in the early stages of a business. So, what lies at the heart of this trend?

An FT article detailing the current state of the venture capital industry sheds fresh light on this issue: the exit market’s lack of meaningful progress. Institutional investors, or limited partners (LPs), face a growing conundrum: they must see a return on their investments to recycle their capital for new investments or commitments. In the absence of a thriving exit market, LPs cannot fulfill this necessity, leading to fundraising difficulties and a curtailing of new deal-making.

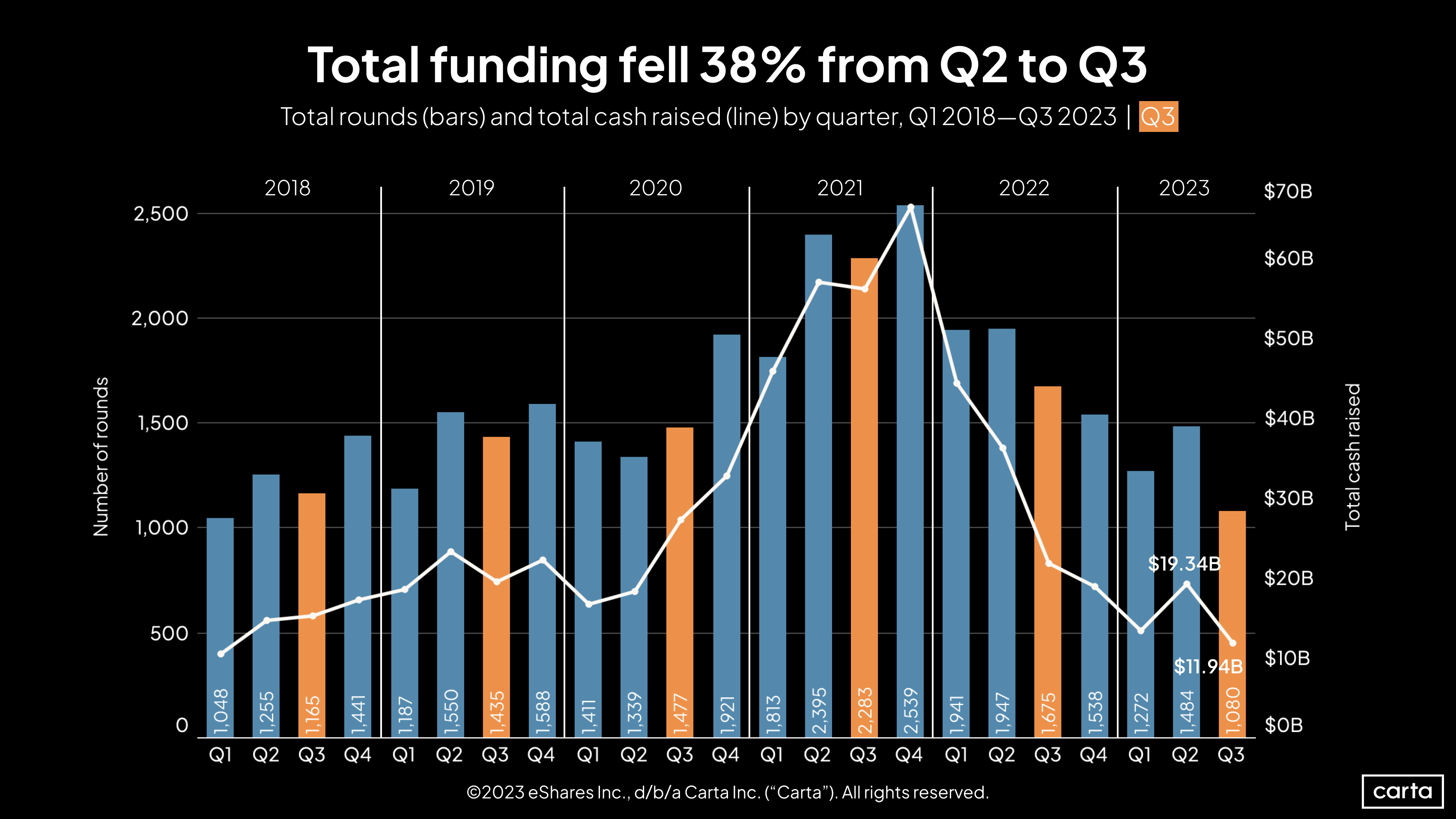

According to PitchBook’s data, a private markets data provider, venture capital firms raised just $9.3bn in the first three months of 2023 in the US, a far cry from the bountiful $555bn they amassed in 2021 – a year already noted for being one of the worst for fundraising since 2016.

The root cause of this trend is that LPs need to realize returns on their venture capital investments in order to re-deploy their capital into fresh opportunities. The absence of a dynamic exit market restricts their ability to do so, ultimately leading to slowed fundraising and deal-making activity. The article predicts that improvement in the exit market is essential to alleviate the lingering challenges for VC fundraising.

The severity and persistence of this trend mark a shift in the venture capital landscape. The era of megafunds, characterized by large, $5bn-$10bn vehicles, has come to a close, replaced by a focus on helping existing portfolio companies reach exit readiness rather than investing in new entities.

The need for a robust exit market cannot be overstated, given that PitchBook data reveals that venture capital firms’ returns have declined significantly, with start-up exits having slowed and interest rates increasing. This stark contrast to the whopping $747.5bn raised in 2021 foreshadows a predicted industry contraction of at least 50% within the next five years.

Moreover, start-ups face potential ramifications from this trend, as restricted access to VC funding makes it harder for them to secure essential capital for growth and innovation. In an unfavorable scenario, this situation could lead to a downturn in the start-up ecosystem, as entrepreneurs may abandon their ambitious plans in light of dwindling opportunities.

To address the core issue, a number of potential solutions can be pursued: encouraged IPO markets, greater focus on nurturing portfolio companies towards exit readiness, and alternative funding sourcesfor start-ups. Overcoming the exit market woes is imperative for the long-term success of the venture capital industry and the entrepreneurial ecosystem as a whole.

As the venture capital industry continues to navigate this challenge, collaboration between all stakeholders – venture capital firms, LPs, policymakers, and entrepreneurs – is crucial. By working together, we can develop more robust and sustainable solutions that will safeguard the future of innovation and growth in the start-up world and beyond.